COVID-19 RESOURCES

Here are some resources to help small businesses.

Jefferson County Chamber of Commerce Plans & Policies

With the everchanging COVID-19 situation, there may be times we are operating remotely; therefore, if you are planning to visit us in office please call beforehand to ensure someone is there to greet you. We can be reached at 865-397-9642.

In the meantime, we hope you continue to interact with us on Facebook and Instagram as we promote our local businesses during our “Follow Friday” program through Local First Jefferson County. We are here for you in any way possible and hope continue to promote and grow our community during this time.

If you have questions or concerns, we ask you to contact the Chamber office by phone at (865) 397-9642 or via email at info@jeffersoncountytennessee.com.

Thank you for your continued support of our Chamber. We wish you, your families and colleagues continued safety and health during this time.

Quick Links

Face It. Masks Fight COVID-19! #TNfights Campaign

Tennessee Governor Bill Lee announced Thursday, July 23, 2020, the State will launch a public service announcement campaign that urges all Tennesseans to fight against the spread of COVID-19 by wearing a mask. The ad campaign, titled “Face It. Masks Fight COVID-19”, will run on broadcast and cable television, digital, social media, print, and billboards statewide.

Information on COVID-19 Case Classification

Clinicians and Laboratories are required to report COVID-illnesses (cases) to TDH. Public health professionals contact every case of COVID-19 statewide to interview them and learn more about their illness, exposures and contacts.

Free COVID-19 Test Kits Available to TN Businesses.

The state of Tennessee has authorized a pilot program for interested Tennessee businesses to obtain COVID-19 tests kits, free of charge while supplies last. The goal of the program, administered jointly by the Tennessee Department of Health and Tennessee Emergency Management Agency, is to help participating businesses demonstrate with greater confidence that their facility is safe to customers and employees. In order to access the test kits, each business must be certified by a training coordinator and follow certain reporting requirements and guidelines.

Businesses interested in utilizing the BinaxNOW rapid antigen tests should review the below guidance documents for using testing supplies and reporting the results:

Directions for ordering supplies can be found here: Ordering BinaxNOW Supplies

Reporting guidance here: Results Reporting Requirements

Training materials for the BinaxNOW test can be accessed here and Abbott can also provide trainings via WebEx.

Please direct any questions to the COVID-19 Testing unit in the Department of Health at covid19.testing@tn.gov.

Jefferson County Health Department is offering assessments for COVID-19.

The Jefferson County Health Department is offering COVID-19 testing times. The current testing times are:

Monday, Wednesday, + Friday: 1:00 PM – 3:30 PM

Tuesday, Thursday: 8:30 AM – 11:30 AM

Testing at the health department remains free of charge and is done by appointment. Please, call 865-397-3930 and press “0.” All testing is drive thru with people staying in their cars for testing.

People who have concerns they may have symptoms of COVID-19 can contact the health department at 865-397-3930 and press 0, for consultation and to talk through potential options for testing in their area.

If you are ill and experiencing symptoms of Covid-19 (fever and cough, shortness of breath or breathing problems) it is recommended you call either your health care provider or the health department first so they can arrange for your arrival to minimize the risk of exposing others to an illness

There are many things the public can do to help flatten the curve and reduce the impact of COVID-19:

- Wash your hands often with soap and water (or alcohol-based hand rub) for at least 20 seconds, especially after coughing or sneezing

- Do not touch your eyes, nose or mouth with unwashed hands

- Stay home when you are sick

- Cover your coughs and sneezes with your arm or a tissue

- Clean and disinfect objects (e.g., cell phone, computer) and high touch surfaces regularly

- Practice social/physical distancing from others, be safer at home

The East Regional Health Office has an information line for local residents and healthcare providers to call with questions or concerns related to the COVID-19 novel coronavirus. The information line is 865-549-5343, and is designed to provide callers with trusted information related to COVID-19. Residents with medical questions will be referred to their health care provider or a public health nurse. The information line is open Monday through Friday from 8:00 a.m. to 4:30 p.m.

TDH has additional information available at www.tn.gov/health/cedep/ncov.html.

The CDC has updated information and guidance available online at https://www.cdc.gov/coronavirus/2019-ncov/index.html

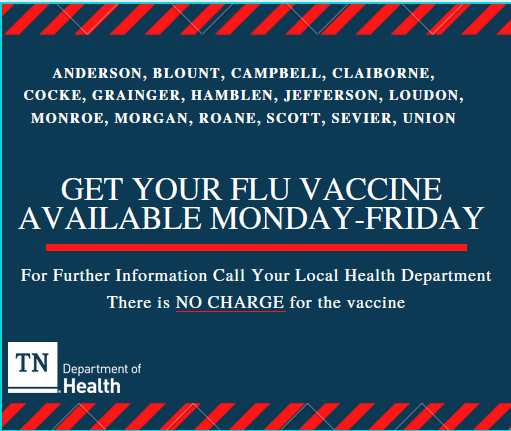

It's Flu Season

This flu season, protect yourself, your family, your friends, and your community. Get a flu vaccine. Call your local health department to schedule an appointment to get your vaccine. Remember there is NO CHARGE.

Tennessee Pledge to Reopen Tennessee

On April 24, 2020, Governor Bill Lee released his administration’s reopening plan, called the Tennessee Pledge. The state’s rollout of guidance and best practices for Tennessee businesses in 89 of 95 counties includes safeguarding protocols such as distancing, usage of face coverings, and capacity measures. The first business sectors to receive guidance through the plan include the restaurant and retail industries. Governor Lee announced yesterday that restaurants could reopen at 50% capacity on Monday and retail stores Wednesday. More guidance will be released next week for other industry sectors.

Additional Resources:

Guidelines for Restaurants and Retail

State of Tennessee Information

Update: On May 22, 2020, Governor Bill Lee signed Executive Order 38 which expanded the number of Tennesseans who may return to work safely while urging continued adherence to health and social distancing guidelines to limit the spread of COVID-19.

Highlights from this order:

Individuals should still practice social distancing, as well as good personal hygiene, and observe other CDC recommendations.

Food and drink establishments may open dining rooms with a limited capacity and still offer drive-thru, take-out, or delivery options. Establishments may sell alcohol in closed containers by take-out or delivery to those age 21 and older.

Gyms and fitness/exercise centers may open with precautions and guidelines in place.

Visitation to nursing homes, retirement homes, long-term care facilities, and assisted-living facilities is limited to essential care-related visits only.

Employers are to be implementing appropriate policies and practices that are in accordance with state and federal guidance.

Preparing Your Business

Businesses and employers can help slow the spread of COVID-19. Follow the CDC’s Guidance for Businesses and Employers for ways to plan, prepare, and respond to the COVID-19 disease.

Employers should create outbreak response plans, including risk management and contingency plans. When creating these plans, make sure they are flexible and include the employees in all stages of development, review, and implementation. Be sure to communicate the plans with employees and explain the resources and benefits that are available to them.

Assistance for Small Businesses

The US Small Business Administration (SBA) is offering low-interest federal disaster loans to small businesses who suffer substantial economic injury during the COVID-19 pandemic. These loans are to be used as working capital for payroll or paying fixed debts, accounts payable, and other bills. Small business owners in Tennessee are eligible for these disaster assistance loans. Find out more information about SBA disaster loans here or apply online.

The SBA Tennessee District Office will host virtual office hours to provide the latest information on how the SBA is helping small businesses with their economic recovery. Each call will address disaster loan criteria, where to apply, how to apply, and will answer questions on any issues with the application process. Only small businesses and private nonprofits are eligible for COVID-19/coronavirus SBA disaster loan assistance. The daily afternoon call is for those impacted by COVID-19 and is at 4:00 PM Eastern time. You can join online or by calling 1-415-655-0003. The access code is 614 098 543.

The Export-Import Bank of the United States is providing relief for exporters and financial institutions who have been affected by COVID-19. Businesses that have experienced shipment problems, liquidity problems, payment difficulties, and other business interruptions may be eligible to receive assistance from EXIM. Find out more about EXIM relief measures here.

Resilience in a Box is designed by the US Chamber of Commerce and is partnered with UPS to teach new business owners about business resilience and best practices. They provide resources to help businesses address preparedness issues and build flexibility to withstand business interruptions. Find out more about Resilience in a Box here.

Additional Resources:

Coronavirus Small Business Guide

Tennessee Department of Labor

Employees can collect unemployment benefits if they are temporarily laid off as the result of their employer closing due to COVID-19 prevention measures. Here are some resources for employers and employees dealing with layoffs.

At this time, there is no longer a distinction between Partial and Mass layoffs. Employers should file an Employer-Mass Filed Claim. Download and fill out this Excel spreadsheet, then email it to partial.claims@tn.gov for review. This process files the claim for all those affected and removes the need for employer response letters.

The TN Department of Labor & Workforce Development released information on the Lost Wages Assistance Program (LWA), a program that will allow the state to work towards paying additional federal unemployment benefits.

Additional Unemployment Resources:

Guide to Partial & Mass Layoff Claims for Employers

Filing Guide for Unemployment Due to COVID-19

Corporate Policy Recommendations

The United States Department of Health and Human Services and the CDC have recommended that businesses:

Ensure sick leave policies are flexible and consistent with public health guidance and that employees understand these policies.

Communicate with vendors that provide contract or temporary employees about the importance of sick employees staying home. Encourage them to create non-punitive leave policies.

Do not require health care provider notes for employees who are sick with acute respiratory illnesses for validation of illness or to return to work. Health care providers are extremely busy at this time and may be unable to provide this documentation in a timely manner.

Employers should have flexible policies that allow employees to stay home to take care of sick family members. Employers should be aware that more employees than usual may need to stay home to take care of sick children or family members.

The US Department of Labor’s Wage and Hour Division provides information on issues employers and employees commonly face when responding to influenza, pandemics, and other public health emergencies, and their effects on wages and hours worked under the Fair Labor Standards Act, the Family and Medical Leave Act, and the Families First Coronavirus Response Act. Find out more here.

US Chamber of Commerce’s Guidance for Employers to Plan and Respond to the Coronavirus (COVID-19)

Emergency Plans for Remote Work

To help prevent the spread of COVID-19, many businesses are asking their employees to work remotely from home. Here are some recommendations from Harvard Business Review for creating plans for remote work:

Acknowledge the possibility that some or all of your workforce may need to work remotely.

Identify which jobs and tasks could be affected.

Audit the available IT software and hardware and streamline access and adoption.

Set up protocol for communication in advance.

Figure out ways to measure performance.

CARES Act Recovery Check

See below for answers to frequently asked questions about the CARES Act Recovery Check. This information is provided by Republican Finance Committee staff for informational purposes and should not be relied on for legal advice. Consult the IRS or a tax advisor to address questions related to individual circumstances.

Who is eligible for a recovery rebate?

All U.S. residents with adjusted gross income under $75,000 ($112,500 for head of household and $150,000 married), who are not the dependent of another taxpayer and have a work-eligible Social Security Number, are eligible for the full $1,200 ($2,400 married) rebate. They are also eligible for an additional $500 per child. A typical family of four is eligible for a $3,400 recovery rebate.

What about taxpayers with adjusted gross income over $75,000 ($112,500 for head of household and $150,000 married)? Are they eligible to receive any rebate?

The rebate amount is reduced by $5 for each $100 that a taxpayer’s income exceeds the phase-out threshold. The amount is completely phased-out for single filers with incomes exceeding $99,000, $146,500 for head of household filers with one child, and $198,000 for joint filers with no children. For a typical family of four, the amount is completely phased out for those with adjusted gross incomes exceeding $218,000.

What if my income was above the threshold in 2019, but I’ve lost my job due to the coronavirus? Can I still get a rebate check?

If your income in 2019 was in the phase-out range you would still receive a partial rebate based on your 2019 tax return. However, the rebate is actually an advance on a tax credit that you may claim on your 2020 tax return. If your income is lower in 2020 than in 2019, any additional credit you are eligible for will be refunded or reduce your tax liability when you file your 2020 tax return next year.

Is the rebate taxable or will I have to pay back any amount if the rebate based on my 2019 return is larger than what it would be if based on my 2020 tax year return?

No, the rebate is treated like other refundable tax credits, such as the child tax credit and earned income tax credit, and not considered income. Moreover, if the credit amount you qualify based on 2020 income is less than what you qualify for based on your 2019 tax return, it does not have to be paid back.

Who qualifies as a child for purposes of the rebate?

Any child who is a qualifying child for the purposes of the Child Tax Credit is also a qualifying child for the purposes of the recovery rebate. In general, a child is any dependent of a taxpayer under the age of 17.

Do dependents, other than children under 17, qualify a taxpayer for an additional $500 per dependent?

No, the additional $500 per child is limited to children under 17.

Are individuals with little to no income or those on means-tested federal benefits, such as SSI, eligible for a recovery rebate?

Yes, there is no qualifying income requirement. Even individuals with $0 of income are eligible for a rebate so long as they are not the dependent of another taxpayer and have a work-eligible SSN.

Are seniors whose only income is from Social Security or a veteran whose only income is a veterans’ disability payment eligible?

Yes, as long as they are not the dependent of another taxpayer. The bill also provides IRS with additional tools to locate and provide rebates to low-income seniors who normally do not file a tax return by allowing them to base a rebate on Form SSA-1099, Social Security Benefit Statement or Form RRB-1099, which is the equivalent of the Social Security statement for Railroad Employees. However, seniors are still encouraged to file their 2019 tax return to ensure they receive their recovery rebate as quickly as possible.

Are college students eligible for a recovery rebate?

Only if they are not considered a dependent of their parents. Generally, a full-time college student under the age of 24 is considered a dependent if their parent(s) provide more than half of their support.

I am eligible for a rebate, what do I have to do to receive it?

For the vast majority of Americans, no action on their part will be required to receive a rebate check since the IRS will use a taxpayer’s 2019 tax return if filed or their 2018 return if they haven’t filed their 2019 return. This includes many individuals with very low income who file a tax return despite not owing any tax in order to take advantage of the refundable Earned Income Tax Credit and Child Tax Credit.

What should I do if I did not file a tax return for 2019 or 2018?

The best way to ensure you receive a recovery rebate is to file a 2019 tax return if you have not already done so. This could be accomplished for free online from home using the IRS Free file program. The bill also instructs the IRS to engage in a public campaign to alert all individuals of their eligibility for the rebate and how to receive it if they have not filed either a 2019 or 2018 tax return.

If I have a past due debt to a federal or state agency, or owe back taxes, will my rebate be reduced?

No, the bill turns off nearly all administrative offsets that ordinarily may reduce tax refunds for individuals who have past tax debts, or who are behind on other payments to federal or state governments, including student loan payments. The only administrative offset that will be enforced applies to those who have past due child support payments that the states have reported to the Treasury Department.

How Does the CARES Act Affect Small Businesses?

See below for frequently asked questions by small businesses that have been impacted by COVID-19.

Is your small business struggling due to the recent coronavirus epidemic?

Your business may be eligible for a new Paycheck Protection Loan. This 4% interest rate loan is 100% guaranteed by the SBA.

Who is eligible?

Businesses and 501(c)(3)s with less than 500 employees.

Where can you get this loan?

Any existing SBA lenders a nd any lenders that are brought into the program through the T reasury. You should talk to your preferred financial lender to see if they qualify.

What can you use the loan amount for?

Payroll costs Group health care benefits Employee salaries Interest on ay mortgage obligation Rent Utilities And any other debt obligations occurred before Feb. 15, 2020

How much can you borrow?

How long will it take to receive the money?

What if you can’t pay it back?

First, all payment on principle, interest, and fees will be automatically deferred for six months. Second, for businesses that retain their staff up until June 30, 2020, this loan will be forgiven.

Can the entire loan be forgiven?

No, only the portion of the loan used to cover payroll costs, mortgage interest, rent, and utilities can be forgiven. In addition, only 8 weeks can be forgiven.

TN Creators Respond

TN Creators Respond is a program created by the Tennessee Chamber to help connect manufacturers with the capability of producing personal protective equipment and needed medical supplies with hospital systems and medical centers in need. Amid a nationwide shortage of testing, N95 masks, and other tools healthcare providers need to protect themselves and their patients against the spread of COVID-19, TN Creators Respond provides a manufacturing pipeline that plugs the gap between producers and healthcare providers. This program builds on Governor Lee’s initiative for private sector businesses to donate excess PPE.

We know that many medical and manufacturing businesses are wondering how they can give and receive help during these demanding times. To find out where/how to donate excess PPE or to connect for production of PPE, enter your information online so they can work with you to make those connections.